Procter & Gamble Company

Stock Chart, Company Information, and Scan Results

$139.63(as of Dec 9, 3:59 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Procter & Gamble Company Company Information, Fundamentals, and Technical Indicators

Stock Price$139.63

Ticker SymbolPG

ExchangeNyse

SectorConsumer Defensive

IndustryHousehold & Personal Products

Employees109,000

CountyUSA

Market Cap$345,081.2M

EBIDTA24,722.0M

10-Day Moving Average147.83

P/E Ratio21.20

20-Day Moving Average147.39

Forward P/E Ratio21.19

50-Day Moving Average149.14

Earnings per Share6.84

200-Day Moving Average157.13

Profit Margin21.22%

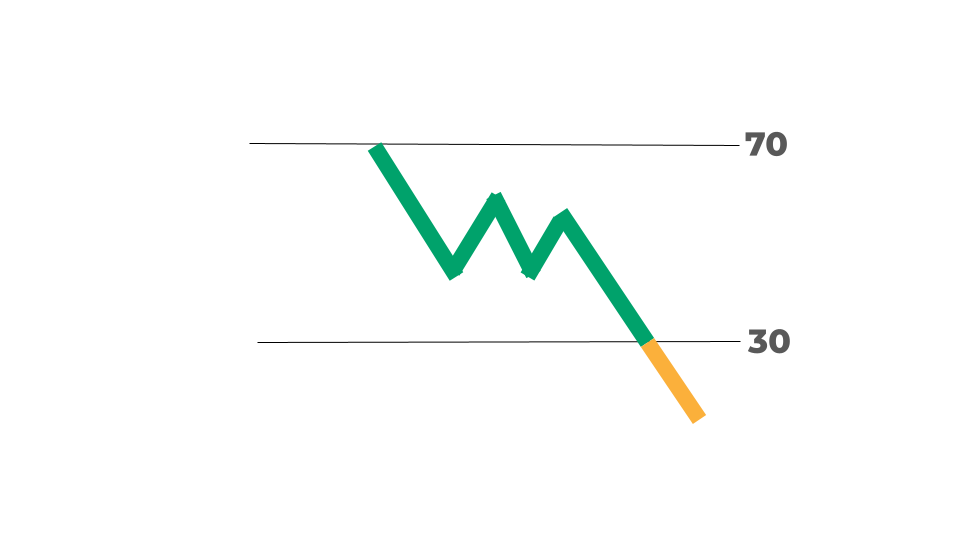

RSI42.38

Shares Outstanding2,336.7M

ATR2.45

52-Week High176.39

Volume12,789,796

52-Week Low142.51

Book Value53,551.0M

P/B Ratio6.64

Upper Keltner152.90

P/S Ratio4.18

Lower Keltner141.88

Debt-to-Equity Ratio152.90

Next Earnings Date01/22/2026

Cash Surplus-26,824.0M

Next Ex-Dividend DateUnknown

P&G is a consumer goods giant and probably one of Wall Street’s favorite value stocks. The conglomerate owns and operates 65 of the most popular consumer staple brands in America including everything from toothpaste to disposable diapers. Its extensive portfolio includes everyday brands like Tide, Crest, and Pampers.

Procter & Gamble Company In Our Stock Scanner

As of Dec 09, 2025

Scan Name: Undervalued StocksScan Type: Stock Fundamentals

As of ---

Scan Name: Increasing Profit MarginScan Type: Stock Fundamentals

As of ---

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Blue Chip Stocks at 52-Week LowScan Type: Stock Fundamentals

As of ---

Scan Name: Increasing Book ValueScan Type: Stock Fundamentals

As of ---

Scan Name: 52-Week LowScan Type: Stock Fundamentals

As of ---

Scan Name: Undervalued Blue ChipsScan Type: Stock Fundamentals

As of ---

Scan Name: Oversold Stocks Scan Type: Stock Indicator Scans

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.